US hotel bookings made via HotelHub dropped by 7.76% compared to Q1 2024

Elsewhere, booking volumes are up in countries including Canada, the UK and France.

Falling hotel prices in major destinations contribute to a stabilisation of the global average rate at $177/night.

HotelHub, the leading hotel booking technology provider for travel management companies, has released their first analysis of 2025 data, revealing a striking drop in US hotel bookings.

The quarterly HotelHub Index – which has examined the 1.9+ million hotel bookings made via HotelHub technology in Q1 2025 – shows that while overall global booking volumes have changed little in comparison to Q1 2024, US bookings have dropped 7.76% in the same period. This decline in bookings comes as the new US administration issues sweeping changes to domestic and foreign policy, sending reverberations around the world.

In contrast, many countries traditionally allied with the US have seen hotel booking volumes rise in Q1 2025. In Canada, hotel booking volumes have risen by 9.94% compared to the same period last year, while reservations in the UK and France have increased by 7.15% and 3.02% respectively. It is too early to say whether this trend points to a definitive shift away from travel to the US; however, the increased booking volume in other regions may be indicative of businesses upping their in-person meetings as they navigate the implications of inconsistent US policy.

While economic forecasts for the rest of the year are looking increasingly volatile, the first three months of 2025 did bring some good news for business travellers when it came to hotel rates. The global average rate per night based on all HotelHub bookings for the quarter was $177, up just 0.19% from Q1 2024 – a stark contrast to the almost 8% rises seen this time last year.

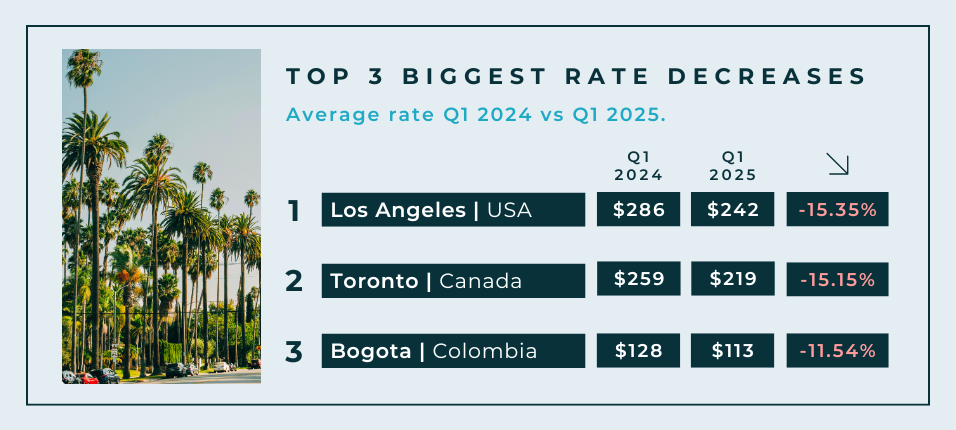

In fact, across many major business hubs, Q1 average hotel rates were down significantly compared to last year. The top three destinations for HotelHub users all saw drops in average hotel rates versus Q1 2024, with rates down 3.92% in London ($281 in Q1 2025 vs $292 in Q1 2024), 3.38% in Paris ($205 in Q1 2025 vs $213 in Q1 2024) and 3.09% in New York ($281 in Q1 2025 vs $292 in Q1 2024).

Meanwhile, a remarkable 15% decrease was noted in both Toronto ($219 in Q1 2025 vs $259 in Q1 2024) and Los Angeles ($242 in Q1 2025 vs $286 in Q1 2024).

Elsewhere, HotelHub’s 2025 findings show that the trend of booking lead time growth has continued from 2024. On average, the length of time between the point of booking and check-in grew by 5.95% in the first three months of the year compared to Q1 2024.

While the global averages show little difference between the rate of growth in domestic booking lead times (+5.49%) and international booking lead times (+5.68%), HotelHub’s analysis reveals the US as an outlier to the trend. Although lead times for international bookings in the US grew by 6.21% in Q1 2025, lead times for domestic bookings actually dropped (-1.68%) for the first time since the end of the Covid pandemic, suggesting a surge in last-minute local travel from US businesses in the first three months of 2025.

Paul Raymond, Director of Business Development at HotelHub, commented:

“While the results of last year’s presidential election were always going to have an impact on the course of 2025, the changes we are already seeing in our HotelHub booking data are significant. Particularly noteworthy are a 7% drop in bookings in the USA’s political centre, Washington DC, and an almost 13% drop in its financial hub, New York. Whether this is a blip or a developing trend isn’t clear, but, moving forwards, we will be keeping a close eye on US bookings in particular.

The volatility we have seen in recent months will almost certainly create more challenges for business travel, but the ability to travel and meet in-person is even more important as business partners try to make sense of the ‘new normal’.”

HotelHub continues to be the premier hotel booking platform, designed to support travel management companies with access to the most complete hotel inventory and best rates sourced from multiple partners. By consolidating content, reporting and payment tools into an end-to-end booking solution, HotelHub ensures greater efficiency and complete data visibility for its users.